- Community

- Seller News

- Buying & Selling

- Product Categories

- eBay Groups

- eBay Categories

- Antiques

- Art

- Automotive (eBay Motors)

- Books

- Business & Industrial

- Cameras & Photo

- Clothing, Shoes & Accessories

- Coins & Paper Money

- Collectibles

- Computers, Tablets & Networking

- Consumer Electronics

- Crafts

- Dolls & Bears

- Entertainment Memorabilla

- Gift Cards & Coupons

- Health & Beauty

- Home & Garden

- Jewelry

- Music

- Pottery & Glass

- Specialty Services

- Sports Mem, Cards & Fan Shop

- Stamps

- Toys & Hobbies

- Travel

- Business Insights

- Regional Groups

- Special Interest Groups

- Developer Forums

- Traditional APIs: Orders, resolutions and feedback

- Traditional APIs: Search

- Traditional APIs: Selling

- eBay APIs: Talk to your fellow developers

- eBay APIs: SDKs

- Token, Messaging, Sandbox related issues

- APIs Feedback, Comments and Suggestions

- RESTful Sell APIs: Account, Inventory, Catalog and Compliance

- RESTful Sell APIs: Fulfillment

- RESTful Sell APIs: Marketing, Analytics, Metadata

- Post Order APIs - Cancellation

- Post Order APIs - Inquiry, Case Management

- Post Order APIs - Return

- RESTful Buy APIs: Browse

- RESTful Buy APIs: Order, Offer

- Promoted Listings Advanced

- Seller Meeting Leaders

- View Item Redesign Updates

- eBay Categories

- Community Info

- Events

- Podcasts

- eBay Community

- Buying & Selling

- Selling

- Can listings be visible to countries I don't ship ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Can listings be visible to countries I don't ship to (2024) ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-19-2024 02:59 AM

Hi,

Is there some setting I can use to have my listings be visible to countries I don't ship to ?

The reasons I want to do this :

1. I am selling on consignment, both me and my client are located in the EU area (where I don't ship to), but he wants to be able to see the store front-end.

2. I was selling to EU until recently. But I have now become a business seller which means that sales inside the EU are burdened with VAT so it is not cost effective any more. Still, I want my old EU customers to be able to see the store, so if they are interested in some item I can propose to them a (higher) price that incorporates the VAT.

Can listings be visible to countries I don't ship to (2024) ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-19-2024 03:21 AM

"I want my old EU customers to be able to see the store, so if they are interested in some item I can propose to them a (higher) price that incorporates the VAT."

I might be reading this wrong. Sounds like you are proposing to sell off eBay after using the site and services to promote your products. Have you read the terms of service?

Can listings be visible to countries I don't ship to (2024) ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-19-2024 03:28 AM - edited 04-19-2024 03:47 AM

You don't need to change anything. You are listing on eBay USA, with item location in Greece, but you only offer Domestic shipping to the USA only. That is all set up correctly to achieve what you want.

The visibility in search is determined by the buyer's shipping location, which is not something the seller can control. Your buyers/clients can view your items by searching on eBay USA www.ebay.com but they will need to change their shipping location to an address in the USA. They may or may not be able to see the VAT cost. On eBay USA it would be a separate line item, not included in the purchase price, but they may have to put the item into the shopping cart and/or go to checkout and change the shipping address to see the VAT.

If a buyer in the EU is interested, you should be able to put their user ID on your buyer-block-exemption list to allow them to purchase. Then you can send an invoice with the correct shipping cost to their location, and eBay will add the correct VAT amount. You should not need to add VAT yourself, because as I understand it, eBay is required to collect and remit the VAT.

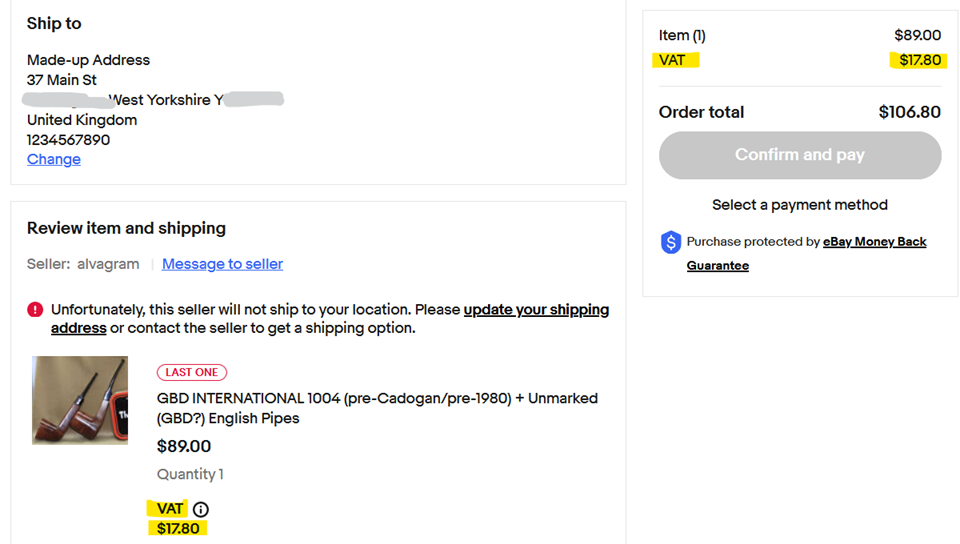

You should ask a friend to use another account to test this out, by putting an item into their shopping cart, but not actually making the purchase. This is what the checkout page looks like when I try this. There's no shipping cost shown because you don't have a shipping cost set up for the UK.

Can listings be visible to countries I don't ship to (2024) ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-19-2024 03:54 AM

Thanks very much for your quick response. In fact except for "domestic" (i.e. USA) shipping, I do offer also international shipping, but not to EU countries.

What you write makes sense, however, for reasons beyond my understanding, UK is the only European country for which Ebay adds (and collects) VAT on top of the selling price.

If the buyer is located eg in Italy I believe he will not see any VAT charged on top. I have to deduct VAT from the displayed selling price and pay it to the local tax authority.

Can listings be visible to countries I don't ship to (2024) ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-19-2024 05:12 AM - edited 04-19-2024 07:11 AM

You don't have any items listed for sale, so I will assume that you are the same person who started this thread but are now posting with a different account, which is fine.

@marale2002 wrote:Thanks very much for your quick response. In fact except for "domestic" (i.e. USA) shipping, I do offer also international shipping, but not to EU countries.

What you write makes sense, however, for reasons beyond my understanding, UK is the only European country for which Ebay adds (and collects) VAT on top of the selling price.

If the buyer is located eg in Italy I believe he will not see any VAT charged on top. I have to deduct VAT from the displayed selling price and pay it to the local tax authority.

The first listing that I checked out, shown in the screenshot in my first reply, only has shipping available to the USA. I looked at some of the others, and they do offer shipping to some other, non-EU, countries.

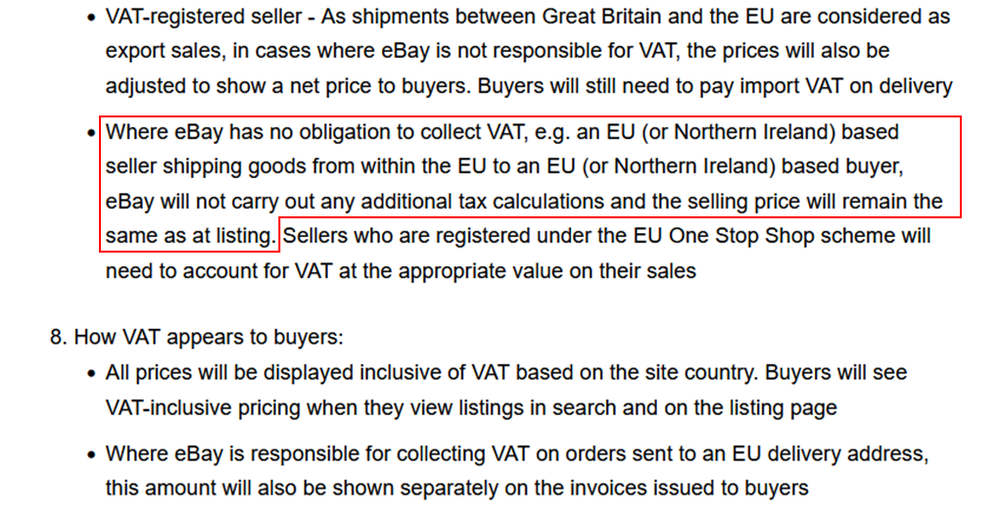

I think that the VAT for the UK address is shown differently, because the UK is not part of the EU anymore, so a business seller in the EU is not assumed to be registered to collect UK VAT. Your items are located in the EU (Greece, specifically) so if they are sold to the UK, they are being imported into the UK, and the purchase price is not assumed to include any amount for UK VAT. (This might be different if they were listed on an eBay website in the EU, but they're not, they're on eBay USA which doesn't have any VAT, just sales tax, which is handled differently than VAT.)

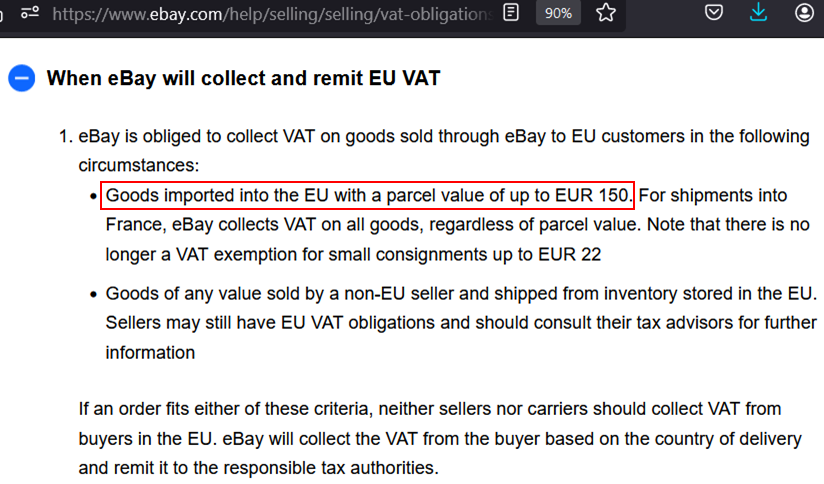

There is more information available about how and when eBay collects VAT in the EU (see below). This indicates that eBay is only required to collect VAT on EU purchases, if the item is being imported into the EU (or if it's being sold by a non-EU seller, even if the item is located in the EU).

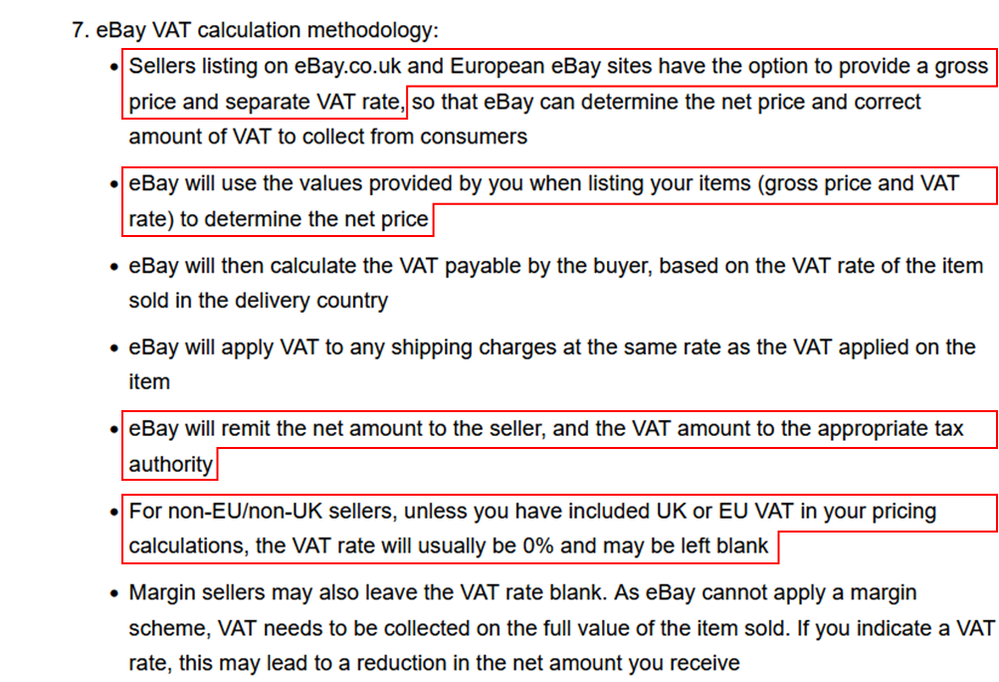

You are an EU seller, and your items are located in Greece, so if you sell within the EU, your items are not being imported into the EU, and eBay does not (is not required to) collect any VAT for those sales. If you are required to pay VAT, then you have to include it in the purchase price.

The information about calculating VAT shown below only applies to items being imported into the EU (or items sold by a non-EU seller).

You have to scroll down to the EU section, then click on the blue circle (on the left) to expand this part:

https://www.ebay.com/help/selling/selling/vat-obligations-eu?id=4650#section6

...

It appears that eBay only collects and remits VAT on imports (as suggested in the first screenshot above), and that would explain why eBay would collect VAT on your listings if they are sold to the UK, because they would be considered to be imports from the EU/Greece to the UK.

According to the information below (from the same link as given above) eBay is only required to collect VAT on goods that are imported into the EU (or UK), not on sales within the EU. In this case, they would not collect VAT for your sales to EU buyers because they are not being imported into the EU (since the items are located in Greece).

If this is the case, then you, as a business seller in the EU, are responsible for including the VAT price in your purchase price so you can remit it. Maybe you can make this work if you list on eBay UK, but I am not sure. Again, this is not something that I can test out because I am not a business seller registered in the EU.

I suspect that the easiest way (possibly the only way) to do this would be to have separate listings:

- listings on an EU eBay site, with the VAT included in the purchase price, which only offer shipping within the EU.

- separate listings on eBay USA, not including VAT in the purchase price, which offer shipping outside the EU.

https://www.ebay.com/help/selling/selling/vat-obligations-eu?id=4650#section6

(continued from above)

Can listings be visible to countries I don't ship to (2024) ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-19-2024 06:27 AM

Not at all. I have been selling on Ebay for more than 15 years, I have never done this and do not intend to start now.

However becoming a business seller is new to me and I am just trying to figure out how I can still sell through Ebay to the EU without loosing part of my selling price to VAT. My first thought was to make special listings to inquiring EU customers with value augmented by VAT, however this will probably create a mess. Perhaps I should be listing in parallel to Ebay EU sites with "VAT not included" -if Ebay allows me to-. I am just researching possibilities in order not to lose sales now that my seller status has switched to business.

Can listings be visible to countries I don't ship to (2024) ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-19-2024 06:34 AM

Sorry for the confusion. Yes indeed I am the same person, I just replied from a different browser (=different ebay account).

Many thanks for the detailed reply. Perhaps the solution is as you suggest to list in parallel to EU ebay sites, provided that ebay will allow me to set "VAT not included".

It seems I have a lot of research to do, but I feel you put me on the right track. I will post again when I can give feedback on your ideas.

I appreciate your help! Many thanks !

Can listings be visible to countries I don't ship to (2024) ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-19-2024 07:08 AM - edited 04-19-2024 07:23 AM

I have updated my reply above, as I gain a better understanding of your situation. This is very complicated. VAT was a lot easier to understand when it was collected locally, and the seller just handed the items to the buyer in person. It's really complicated now that distance selling has to be taken into account.

Check out my updated reply, and I hope that it helps.

At this point, I think that having separate listings, on an EU-based eBay site for sales within the EU, and on a non-EU site (probably eBay.com as you are already established there) for sales outside the EU, is the best way for you to go forward. You can use the same account for all the listings, just be careful which site you are logged on to when you make new listings.

I would put a brief explanation into your descriptions, explaining that your EU listings include VAT in the purchase price for buyers in the EU, while your listings for sales outside the EU don't include VAT because non-EU buyers don't have to pay VAT. eBay does collect sales tax or GST for most sales outside the EU (which is transparent for the seller).

On a side note:

What happens to the VAT if you sell something to a buyer outside the EU? They don't have to pay VAT, of course, but didn't you have to pay VAT when you purchased or acquired the item for sale? How do you recover that, if you don't report the sale with the VAT collected from the purchaser?

Can listings be visible to countries I don't ship to (2024) ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-20-2024 01:47 AM

I can't thank you enough for your help. I will proceed with the idea of double listing the items, both on the .com and an EU site. This appears to be the best (perhaps the only) option.

Things would be much much simpler if Ebay could automate collection on VAT on top of sales price, the same way it collects State Tax from buyers located in USA, or GST from buyers located in the UK and Australia.

But, as experience shows, in some aspects Ebay works in mysterious ways...

As for the recovery of purchases VAT, in my case I don't pay purchases VAT because my purchases are from private individuals in which case VAT does not apply (in its place there is a small stamp fee on purchase invoices which I cannot recover, it becomes part of my general costs). In the general case, i.e. when a seller buys from suppliers (with VAT) and sells only outside the EU (without VAT), he of course cannot recover VAT from sales on Ebay. Instead, he can recover it from non-Ebay local or EU sales if he has any, or simply apply to the tax authority for VAT return.

Can listings be visible to countries I don't ship to (2024) ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

04-20-2024 05:10 AM - edited 04-20-2024 05:11 AM

@alvagram wrote:

I can't thank you enough for your help. I will proceed with the idea of double listing the items, both on the .com and an EU site. This appears to be the best (perhaps the only) option.

Things would be much much simpler if Ebay could automate collection on VAT on top of sales price, the same way it collects State Tax from buyers located in USA, or GST from buyers located in the UK and Australia.

But, as experience shows, in some aspects Ebay works in mysterious ways...

...

eBay only collects the sales tax and GST in those countries because they are required to by law. The same reason as collecting VAT on imported goods; the EU passed a law that requires eBay to collect and remit the VAT, because eBay operates inside the EU and is subject to the EU laws. Sellers outside the EU, and selling into the EU (imported goods) are not subject to EU law so they can't require foreign sellers to comply with the law about collecting VAT. But they can make eBay do it.

eBay fought long and hard against being required to collect sales tax in the USA, but the laws were passed here anyway.

...

As for the recovery of purchases VAT, in my case I don't pay purchases VAT because my purchases are from private individuals in which case VAT does not apply (in its place there is a small stamp fee on purchase invoices which I cannot recover, it becomes part of my general costs). In the general case, i.e. when a seller buys from suppliers (with VAT) and sells only outside the EU (without VAT), he of course cannot recover VAT from sales on Ebay. Instead, he can recover it from non-Ebay local or EU sales if he has any, or simply apply to the tax authority for VAT return.

Thank you for that explanation. I appreciate it.